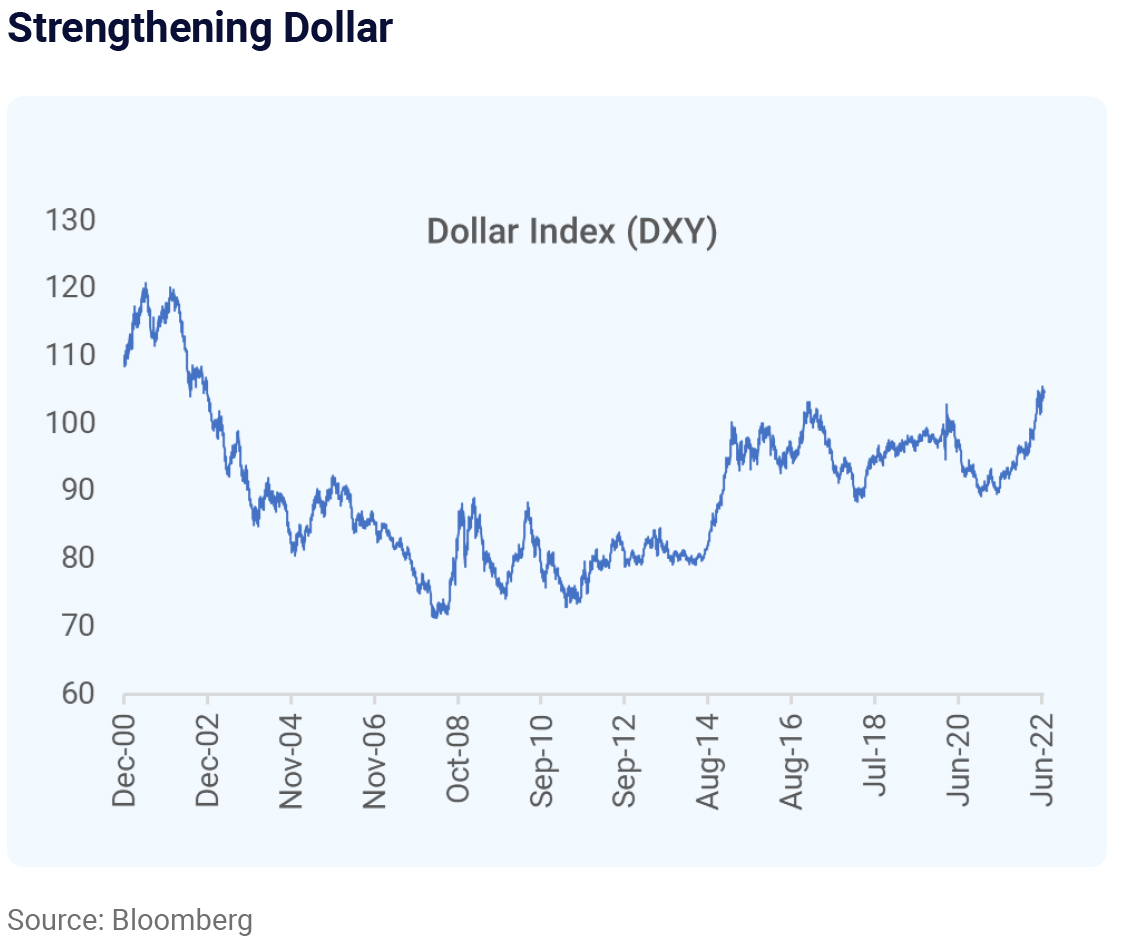

The US dollar has been soaring – now up 11.0% (YTD, as of July 5, 2022), as the Fed prepares to hike interest rates to tame inflation aggressively. Along the same lines, several central bankers worldwide are trying to combat inflation by interest rate hikes

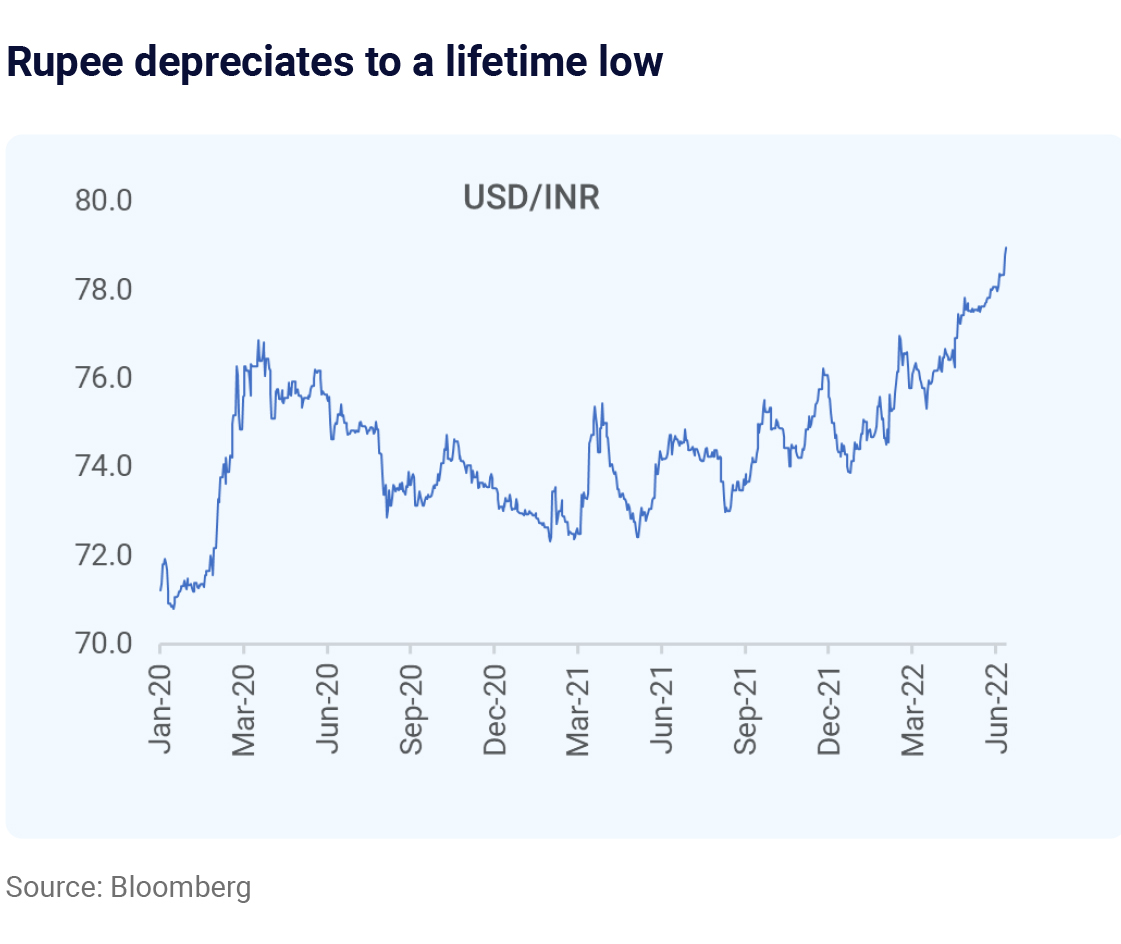

Whether it is a result of deliberate economic policies or a side-effect of rising interest rates, the currencies of these countries are getting stronger. A stronger currency helps these countries reduce the cost of imports and inflation. This mechanism has been coined “Reverse Currency War” as countries sought the opposite for decades. A weaker currency meant domestic companies could sell goods/services abroad at more competitive prices, aiding economic growth. But with inflation soaring, strengthening buying power has suddenly become more critical. However, if left unchecked, a stronger currency could handicap manufacturers who rely on exports as they risk losing business to their foreign competitors. Also, it is unclear how much a strong currency helps to tame inflation. On the domestic front, the Indian rupee also has weakened, touching a new lifetime low against the US dollar. Apart from a strengthening dollar, widening trade deficit and foreign outflows further added pressure on the rupee. The RBI has unveiled several measures to attract foreign investments and stall the pace of rupee depreciation. But, given the risk of recession, impending rate hikes by the Fed, and sticky domestic current account deficit, the risk of further depreciation of the Indian rupee continues to loom. Cooling off oil prices can be a significant factor supporting the rupee.