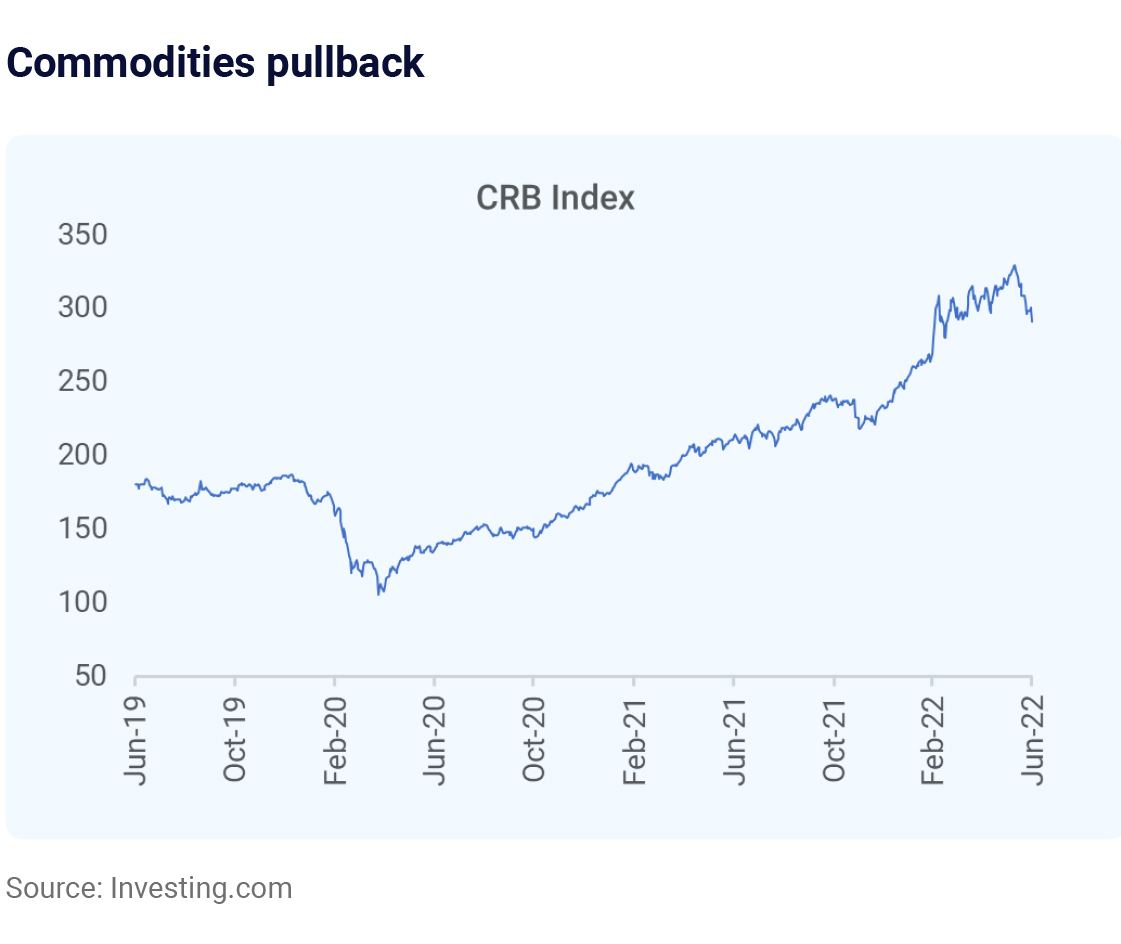

Despite the recent correction, commodities have had a massive

outperformance over the past two years. The prospect of Fed rate hikes,

fears of a global economic slowdown, and a strong US dollar have put

brakes on the surge in commodity prices.

However, we believe we are still in the commodity super-cycle given the

demand-supply equation. On the demand side, decarbonization

movements and economic restart post the pandemic shutdown have kept

the demand for most commodities high. However, on the supply side,

years of underinvestment have resulted in woefully inadequate supply for

pretty much every kind of commodity. Typically, it takes 5-7+ years to add

any new capacity in the commodity space, and we cannot expect an

However, we believe we are still in the commodity super-cycle given the

demand-supply equation. On the demand side, decarbonization

movements and economic restart post the pandemic shutdown have kept

the demand for most commodities high. However, on the supply side,

years of underinvestment have resulted in woefully inadequate supply for

pretty much every kind of commodity. Typically, it takes 5-7+ years to add

any new capacity in the commodity space, and we cannot expect an

investment spree today to fix the structural supply deficit in the immediate future. Thereby, we believe tight supply and demand conditions for most commodities should limit the downside from here. As global growth prospects improve, we expect commodity prices to rebound. In the near term, the main risk to commodity prices would be a more profound deterioration of macroeconomic conditions.