The equity market had convinced itself following the July FOMC meeting

that after two consecutive quarters of negative real GDP, the US Fed shall

make a "dovish" pivot. However, cracks emerged following the FOMC

chairman Jay Powell’s speech at the Jackson Hole symposium, reiterating

its stance to raise interest rates until the inflation is under control.

This led to a major sell-off in equity markets across the globe. Indian

markets were no exception. Beyond the kneejerk reaction in the equity

markets, the long-term risk of capital outflows from emerging economies

like India re-surfaces.

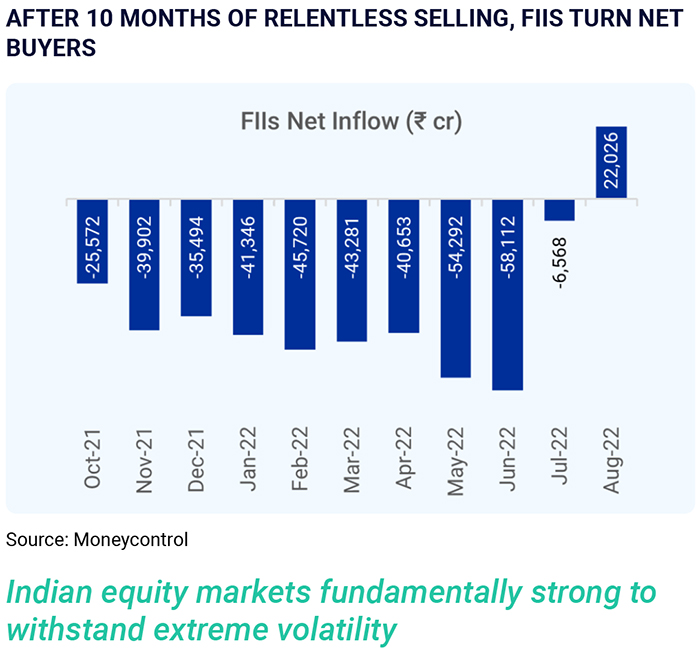

However, Indian markets witnessed a steep rebound in the next few days

and recovered most of the losses while other major global markets

continued to bleed. The resilience shown by the Indian markets reflects

robust macroeconomic fundamentals. India is one of the fastest growing

economies, while other major economies are heading towards recession

or growing at a moderate pace. Another positive for the Indian economy

has been softening of commodity prices and easing of supply chain

pressures which has led to an easing of imported inflation (CPI for India

peaked in April 2022). Also, the foreign exchange reserves of $561 bn

provide a cushion against any external shock. All the above fundamentals

have reinstated the confidence of investors in the Indian market which is

reflected in surging portfolio inflows by foreign institutional investors

(FIIs).