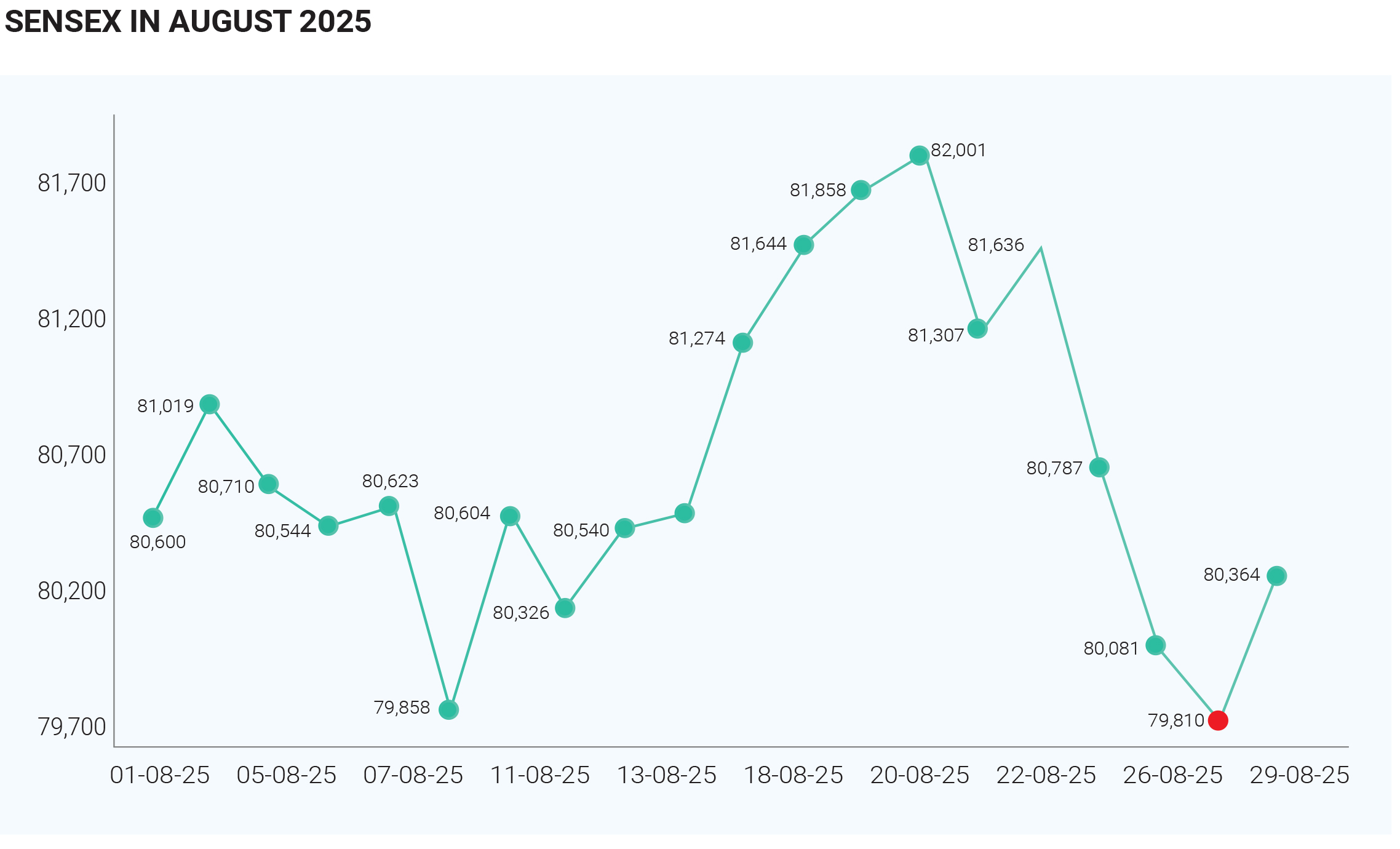

In August 2025, the Indian equity markets experienced a month characterized by modest headline gains but significant underlying volatility, as the Sensex and Nifty 50 reflected a tug-of-war between adverse global events, heavy foreign outflows, and supportive domestic developments. The Sensex largely hovered near the crucial 80,000 mark and closed at 80,718 on September 4, registering a marginal uptick of just 0.01%, while the Nifty 50 ended at around 24,735, showing a similarly muted advance of approximately 0.08%, and although these percentage gains were minimal, the real story of the month was the sharp intra-day swings and sectoral churn that kept investors on edge. Notably, indices witnessed abrupt declines of nearly 1% on August 8 and

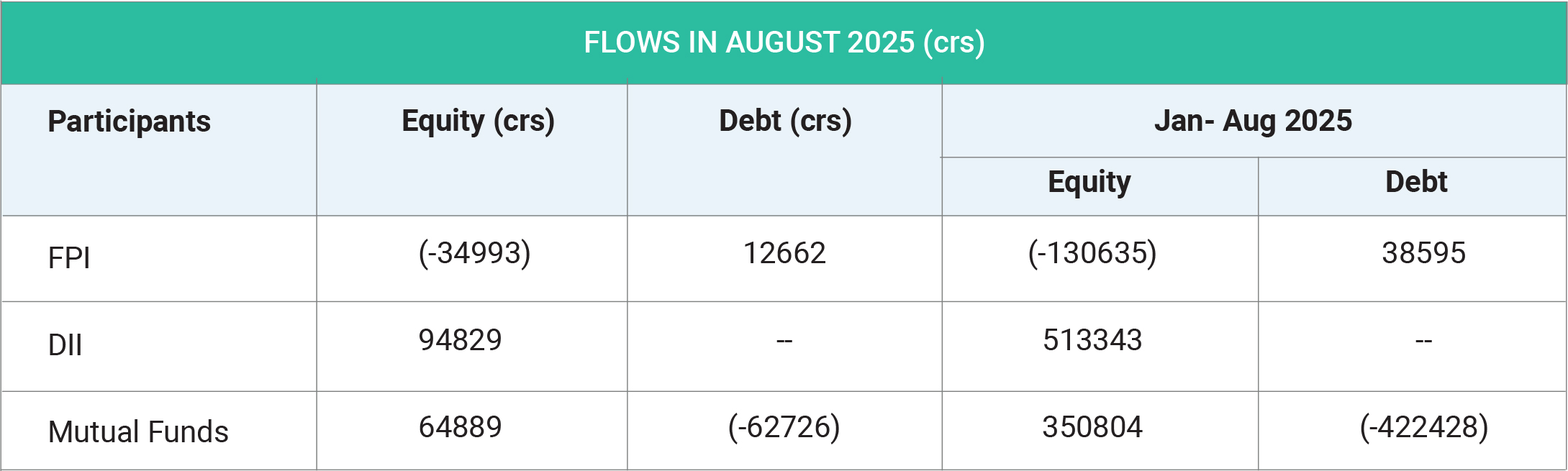

26, reflecting fragile sentiment and investor risk aversion amid mounting concerns over global trade tensions and currency depreciation, reacting sharply to any adverse headlines. The primary catalyst for this heightened volatility was the escalation of trade tensions between India and the United States, as tariff threats hung heavily over market sentiment throughout the month, culminating in Washington’s decision on August 27 to impose a steep 50% tariff on Indian goods, doubling the earlier 25% rate set in July, in response to India’s purchase of discounted Russian oil. This move directly targeted critical export sectors such as gems and jewellery, textiles, footwear, and industrial chemicals, sparking fears that Indian exports to the US could contract by as much as 43%, triggering sharp selloffs across related sectors and accelerating foreign institutional investor (FII) exits. As a result, FIIs remained persistent net sellers throughout the month, withdrawing an estimated ₹47,000 crore from Indian equities, citing not only tariff fears but also the backdrop of a strengthening US dollar, elevated global bond yields, and lingering uncertainty over US economic policy. Export-oriented industries like IT, pharmaceuticals, and specialty chemicals bore the brunt of this selling, dragging down valuations and leading to broader corrections across the benchmark indices. These sustained FII outflows also placed downward pressure on the rupee, which slid close to an all-time low of ₹87.66 per dollar on August 4, adding another layer of vulnerability to sectors dependent on imports and further denting market confidence. Yet, despite this pronounced external weakness, the Indian market avoided a steeper correction thanks to the robust counterbalancing role played by domestic institutional investors (DIIs), who acted as shock absorbers during turbulent phases. DIIs, including mutual funds, LIC, and insurance companies, injected a massive ₹95,000 crore into equities during the month, nearly double the amount withdrawn by FIIs, and this strong domestic buying, focused particularly on fundamentally sound sectors like banking, infrastructure, and consumer goods, helped cushion the indices against deeper falls. These capital flow dynamics, sectoral performances were uneven, with auto and FMCG sectors delivering robust gains driven by healthy domestic sales and resilient consumption demand, while pharma, financials, and defence counters came under pressure due to global headwinds and tariff uncertainties. The market was influenced by phases of profit-booking, as investors locked in early-August gains from heavyweight stocks, occasionally pushing indices into negative territory, though recoveries were often aided by positive domestic policy moves. One of the most significant domestic policy developments was the Group of Ministers’ approval on August 21 of a major simplification in the Goods and Services Tax (GST) structure, which proposed merging most rates into two slabs of 5% and 18% with expected implementation by late September. This reform was interpreted as a potential consumption booster ahead of the festive season, benefiting consumer-focused sectors and fuelling optimism that supported markets during an otherwise challenging month. In contrast, another notable domestic move—the passing of the Promotion and Regulation of Online Gaming Bill, 2025, which imposed a complete ban on real-money online gaming—negatively impacted listed entities in the digital gaming space, showing the divergent effects of sector-specific policy. Macroeconomic indicators also provided resilience: India’s GDP growth was projected at a strong 6.5% for FY25, while the services sector PMI reached a 15-year high of 62.9 in August, signalling robust expansion in domestic services activity. Inflation, meanwhile, remained subdued, with even food inflation turning negative, supporting rural consumption and bolstering the outlook for consumer demand. The Reserve Bank of India maintained its accommodative stance, keeping the repo rate steady at 5.5% while ensuring liquidity and credit flow, with the benign inflation backdrop giving policymakers room to support growth without stoking inflationary pressures. Export performance too remained encouraging in certain areas, as shipments rose nearly 6% year-on-year in Q1 FY26, aided by government initiatives like the Foreign Trade Policy 2023 and the Make in India program, which particularly boosted electronics competitiveness. On the global front, in addition to tariff escalations, other developments also weighed on Indian equities: persistently high global interest rates in the US and EU constrained liquidity and kept capital flows under pressure, while muted global growth forecasts from the IMF and World Bank underscored weakening demand in key export markets such as the US, EU, UK, and Germany, particularly hurting India’s IT, textile, and pharmaceutical sectors. At the same time, the Jackson Hole Economic Symposium provided a temporary boost to sentiment when the US Federal Reserve Chair hinted at the possibility of rate cuts in the near future, offering hope of eventual liquidity easing. Nevertheless, the net effect of global events remained heavily skewed toward caution, as evidenced by FII outflows exceeding ₹35,000 crore during the month, largely in response to trade tariffs, weak global demand, and rupee depreciation. Overall, August 2025 was a month of contrasts for Indian markets: on one side, heavy foreign selling, tariff shocks, rupee weakness, and global uncertainty drove sharp volatility and tested investor nerves, while on the other, strong domestic inflows, policy reforms like GST simplification, resilient macroeconomic data, and sectoral bright spots in autos, FMCG, and banking prevented steep corrections and kept benchmarks range-bound. The broader implication was that the Indian market demonstrated increasing resilience against global shocks, as domestic liquidity and retail participation emerged as decisive stabilizers. The August narrative highlighted the evolving balance of power between FIIs and DIIs, the vulnerability of export-oriented sectors to external shocks, the growing importance of domestic consumption in sustaining momentum, and the capacity of policy reforms to shape investor sentiment, making the month a vivid case study in how external turbulence and internal resilience can coexist to define the trajectory of India’s financial markets.